Contents:

Company X holds rights to modify the structure of directorship of Company Y; Company Y holds similar rights in company Z, then company X is the parent company to both Y and Z. Holding companies usually don’t directly manage their subsidiaries, however. When a company is acquired by a holding company, its existing management often stays in place.

Bumble Inc. Announces Pricing of Secondary Offering of Shares of Class A Common Stock – Yahoo Finance

Bumble Inc. Announces Pricing of Secondary Offering of Shares of Class A Common Stock.

Posted: Fri, 03 Mar 2023 05:18:00 GMT [source]

We’re happy to converse with both you and your CPA in a conference call, to help you implement a tax structure your CPA understands and supports. Please note we charge extra for our tax attorney consult, and that it is not included in the base price of an Anonymous LLC or LLC Formation . When forming a parent/child LLC structure, you may want to elect for one of the LLCs to be taxed as a Subchapter S Corporation (for more on why you might consider such an election, read A S-Corporation May Help You Save a Lot in Taxes). If you decide to elect S-Corp tax treatment, the question becomes “which LLC”? Each of the Guarantors hereby subordinates to the Obligations all indebtedness or other liabilities of the Borrowers or of any of their respective Subsidiaries or of any other guarantor of the Guaranteed Obligations or other Obligations to such Guarantor. The provisions of this Section 3 shall survive repayment of the Obligations subject to the limitations set forth in Section 13.04 of the Credit Agreement, which limitation shall also apply to this paragraph 3.

It depends on the extent of managerial authority provided to the managers of the subsidiary firm. A parent company neither possesses the power to control the management and business decisions of their affiliated companies nor can they control the selection of the board of directors. Purchase all of the outstanding ownership interest in an existing business.

This would later help in enhancing the overall revenues of the parent company. In an alternate arrangement, parent companies and subsidiaries can be integrated horizontally, such as Gap Inc, which is the owner of the Banana Republic and Old Navy. They can also be integrated vertically by being the owner of various companies at several stages of the supply chain or production. Subsidiary financials appear on the parent company’s financial statements.

Definition of a Subsidiary Company

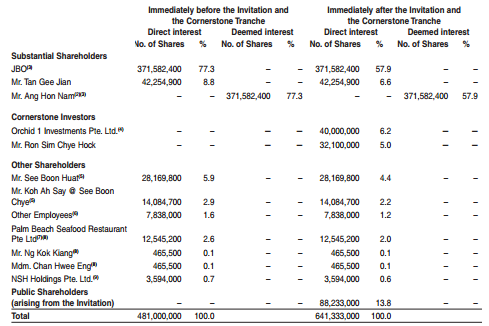

When a https://1investing.in/ company controls 80% or more of its subsidiaries voting stock, it qualifies to receive tax-free dividends from that subsidiary company. Also, in some states, a subsidiary is only taxed on the profit it generates in that state, rather than the total profits of the parent company. A subsidiary is a company that is owned or controlled by another company, usually referred to as its holding company or parent company.

- Subsidiaries of parent companies may face liability it the parent company’s business activities result in a legal loss or bankruptcy.

- An LLC subsidiary wholly owned by a single corporate parent is considered a single-member LLC by the Internal Revenue Service.

- This means that the tax bill of the entire group may be lower than if all the members filed separately.

- Digital marketing is a means of advertising and selling products through the internet, mobile devices, social media, search engines, display advertising, and other channels.

As a majority stockholder, the parent company has the ability to remove or appoint board members for the subsidiary company and is also allowed to decide how the subsidiary will operate. Generally, a business manages its finances on a yearly basis by subtracting expenses from revenue to arrive at net income, then paying taxes on net income to determine how much it has left over in profit. The business then can distribute all or a portion of profits to its owners. A corporation’s board of directors can vote to distribute all or a portion of the company’s profits to shareholders as dividends, while an LLC can distribute profits to members based on the way the company has chosen to be taxed. Limited liability for owners of independent legal entities, such as an LLC, is not absolute.

They can purchase 51% of two companies instead of purchasing 100% of one. And sometimes control can be acquired for much less than 51%, allowing investors to achieve greater diversification without relinquishing control. Certain tax benefits accrue to holding companies that own greater than 80% of the shares in a company. Pure Holding Companies – companies created solely to own stock in a number of other companies. In some states, a business owner can set up a corporation or LLC with a nominee manager, allowing the true ownership of the company to go undisclosed.

Meet some of our Parent Company Guarantee Lawyers

An affiliated company differs from a subsidiary through the size of the ownership. A subsidiary is a company where 50% or more of the company is owned by another. A key characteristic of an affiliated company is that less than 50% of the company is owned by an individual shareholder. Any parent company of the affiliated company is considered a minority shareholder. A subsidiary is an independent company that is more than 50% owned by another firm. The owner is usually referred to as the parent company or holding company.

Save taxes with ClearTax by investing in tax saving mutual funds online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner.

Under state laws, an LLC is a business entity that has independent status apart from its owners, known as members. The company transacts business under its own name, such as entering into contracts and owning real property. The members enjoy limited liability for business affairs and typically can’t be sued personally for transactions conducted in the name of the LLC. Using the LLC structure to conduct business ensures that business creditors and other claimants can’t go after the personal assets of the members; only the amount of money that each member has invested in the LLC is at risk. There may be some confusion with respect to how funds are supposed to move up and down the ownership chain. With an anonymous parent-child LLC structure, funds should move into the parent company if, for example, you’re looking to take an ownership draw/distribution of the profits made by the child company.

Larger companies generally purchase smaller companies outright in order to avoid competition, enhance their areas of operation, to lower the burden of debt, or to gain unification. The parent can exert influence but lacks control over business decisions and the board of directors. This means that each of the affiliated companies combined can have more value together than the sum of their parts. If they possess complementary businesses and resources, both can benefit from each other.

Forming a Parent LLC

The subsidiaries may have different legal structures, and you can create numerous layers of subsidiaries. You should draft the subsidiary’s share certificates and make them out to the parent company. The share certificates should be sent to the registered agent of the parent company for safekeeping.

Creating an LLC parent company is rather simple, all one would need to do is list the name of the first LLC as an owner of another business subsidiary or company they are going to form. By doing this, the first LLC formed becomes an owner and member of the second LLC or business subsidiary formed. And an LLC can be formed in 6 steps, according to TRUiC, so in essence an LLC can become a parent company in those 6 steps.

A holding or parent company may own a smaller stake, including less than 50%, as long as it gives the subsidiary’s managers day-to-day control. But to be a holding or parent company it must have overall control of the subsidiary, being able to hire and fire executives and set strategy. The controlling stake is one thing that distinguishes holding companies from mutual funds and hedge funds that have minority stakes in companies. Certain business entities create separation between the business owner’s personal assets and the assets and liabilities of their business. This is referred to as a corporate veil and shields the business owner’s personal assets from liabilities arising out of their business’s activities.

Larger companies often buy out smaller companies to alleviate competition, broaden their operations, reduce overhead, or to gain synergies. For example, Meta , formerly Facebook, acquired Instagram to increase overall user engagement and strengthen its own platform, while Instagram benefits from having an additional platform on which to advertise and more users. Meta, however, has not exerted too much control, keeping an autonomous team in place, including its original founders and CEO. A parent company is a single company that has a controlling interest in another company or companies.

Mickle- Reed, LLC parent of UCM Collections

For instance, AT&T’s parent company llc of Time Warner meant that it became owner of both the film production business and broadcasters that sold those productions to audiences, in addition to its telecommunications networks that provided the media infrastructure. Whether being organized as a holding company is a good idea for your business is something a financial advisor can help you with. SmartAsset’s free toolmatches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals,get started now. A subsidiary may enjoy lower borrowing costs if the holding or parent company chooses to make itself potentially liable by guaranteeing the subsidiary’s debts. Looker, founded in 2011 by Lloyd Tabb, helps companies to easily extract and analyze data.

Every state has a business code that provides for the formation and registration of entities, including corporations, LLCs and partnerships. You can choose to form any type of business to serve as your LLCs subsidiary, including another LLC. Prepare the proper formative paperwork, such as articles of incorporation or articles of organization, for filing with the state agency that handles business registrations, usually the secretary of state.

You may also need to file a DBA for your parent LLC in any other states in which your subsidiaries operate if you plan on using your parent LLCs name to do business there. An S-Corporation (or “S-Corp”) cannot be owned by a partnership or another corporation – or an LLC taxed as either. Nor can an S-Corp be owned by “nonresident aliens” – a term used in the Internal Revenue Code to refer to non-citizens not permanently residing within the United States. Brandon is a Texas Super Lawyer®, meaning he is among the top 2.5% of attorneys in his state.

التعليقات مغلقة.